Today, at Steer Davies Gleave, traffic demand and revenue forecasts are regularly prepared for privately funded infrastructure projects, especially toll roads, tunnels, and bridges. Unlike the seers of old, we acknowledge that predicting the future isn’t easy and consequently, although deriving a view of the future is a key aspect of the work, equal effort is put into quantifying areas of uncertainty and risk.

Today, at Steer Davies Gleave, traffic demand and revenue forecasts are regularly prepared for privately funded infrastructure projects, especially toll roads, tunnels, and bridges. Unlike the seers of old, we acknowledge that predicting the future isn’t easy and consequently, although deriving a view of the future is a key aspect of the work, equal effort is put into quantifying areas of uncertainty and risk.

While there is great interest in predicting the future, there is as much curiosity about whether these forecasts are correct. At Steer Davies Gleave, this interest increased dramatically a few years ago when Standard and Poor published a paper claiming that traffic levels on toll road are typically over-forecast by 20-30%, which they attributed to a clear case of “optimism bias”.

The paper was greeted with concern at Steer Davies Gleave. While we had never formally reviewed our forecasts, feedback from clients didn’t match this finding. There was only one thing to do. We carried out our own research to determine the accuracy of our toll road forecasts.

However, this wasn’t as simple as it sounds due to four factors:

- Client confidentiality - our reporting must be general and can’t reveal specific schemes or figures.

- Scheme definition - opening dates and even toll levels and categories are all subject to change post-forecast.

- Which forecasts? - the scheme adopted by our clients is not always the same one that forecast for.

- Ramp up - it may take time for users to adjust to new or changed routes and this can be enhanced by delayed opening of sections etc. Comparison of forecast and actual traffic (outturn) should be undertaken once the system has settled down.

Despite these problems, we have established a library of forecasts and outturn traffic and revenue values. Using these data, we have been able to assess the accuracy of our forecasts and learn some valuable lessons.

Our research findings:

The following comparison of forecasts and actual traffic provide a broad indication of our track record for schemes in which outturn data are available.

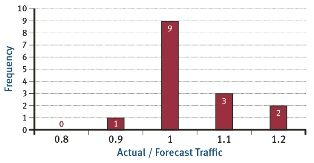

Our research data is based on forecasts for seven shadow toll roads in the UK and user-pay toll roads in Canada, Jamaica, South Africa and Poland. The results are shown below.

Where the comparison is <1, our forecasts over-predicted the outturn traffic, conversely a comparison >1 suggests an underestimation.

The forecasts show a distribution around the outturn value (acknowledging the sample is relatively small) with no obvious evidence of bias including “optimism bias”. For the majority of schemes analysed, our forecasts have been within 5% of the actual outcome. The only scheme that underperformed was influenced by an unexpected external factor. The majority of schemes that we under-forecast were affected by a toll reduction that was later implemented, which resulted in higher traffic flows.

But don’t just take our word for it. The accuracy of Steer Davies Gleave’s forecasts for two toll roads in South Africa has also been investigated by MTH Pycraft and I Macaulay in their paper ‘Demand Forecasting Risk in Project Financing of Toll Facilities’ University of Witswatersrand (2006). With reference to the S&P paper, the authors concluded that:

“The South African user-paid toll roads scheduled performance [ratio of actual traffic volume to forecast traffic volume] is significantly greater or better than not only the entire world results, but also the developing nations scheduled performance results”.

In light of both these results, we are confident that we deliver accurate forecasts and a clear analysis of uncertainty and risk and are continuing to update the database of research, drawing on our findings to improve understanding of the demand for toll facilities worldwide and are grateful for the support our clients have given in assisting us with the analysis.